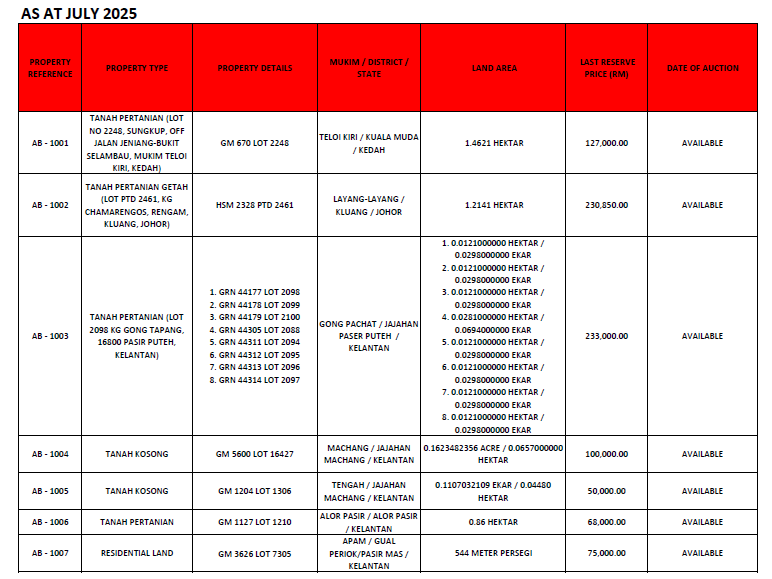

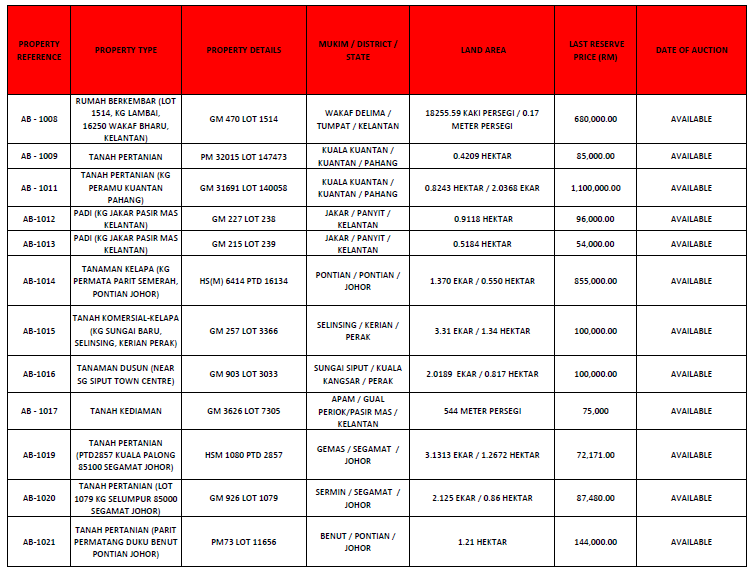

Download pdf version

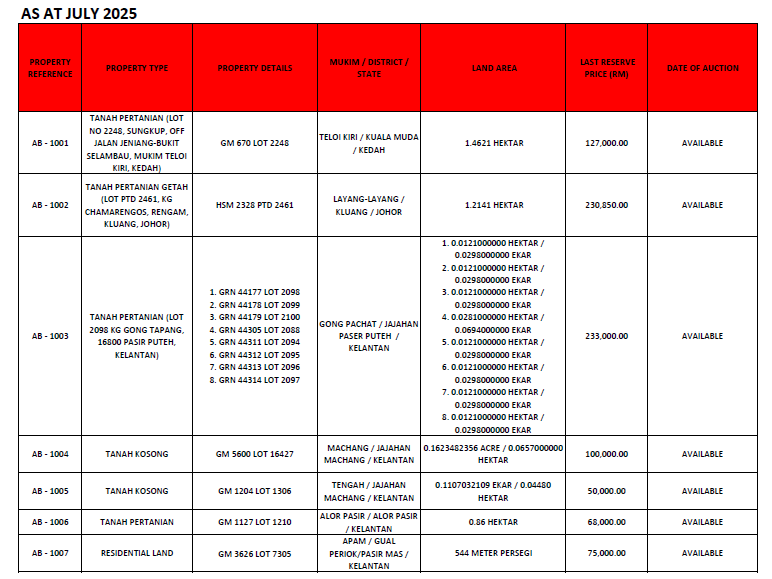

Disclaimer:

Interested bidders are advised to conduct all necessary searches, verification and/or inspection on the accuracy and correctness of the particulars and information provided prior to the bidding of the respective auction properties.

Bidders are advised to refer to proclamation of sale for further details on the auction. Take note that the Bank Pertanian Malaysia Berhad (“Agrobank”) shall not hold liability for any discrepancies of the information provided (if any).

Agrobank reserves the right to withdraw/called off/postpone any properties listed at any time without prior notice to the prospective bidder, Real Estate Agent and any other parties and without having to provide reasons or grounds whatsoever and shall not be held responsible for such withdrawal.

Enquiries are welcomes. Kindly email auction@agrobank.com.my or contact 03-2731 1600 (extension 1023 / 2634).

CONTACT US

Hartani-i provides financing to government servants, private sector employees (permanent and contract) and stable income earners for purchasing agricultural land.

Purchase of land includes directly purchase from the vendor or through public auction or purchase of land that will be or have been auctioned by Bank Pertanian Malaysia Berhad (Agrobank).

The Bank will only consider the financing if the land to be purchased has the individual title or the land has been sub-divided and/or the land which individual title is to be issued.

Shariah Concept applied:-

- A Tawarruq consists of two sale and purchase contracts. The first involves the sale of an asset by a seller to a purchaser on a deferred basis. Subsequently, the purchaser of the first sale will sell the same asset to a third party on a cash and spot basis. Through this financing, the Bank will buy the commodity (a prepaid credit or any other commodity as advised by the commodity) from the Commodity Broker at cost price (based on the financing amount). Subsequently, the Bank sells the commodity to the Customer at cost plus profit (Murabahah) on deferred payment. Next, the Customer appoints the Bank as an agent (Wakalah) to sell the commodity at cost price in cash to a third party, on a cash basis. Proceeds of the sale will be credited to the Customer’s account as the financing amount required by the Customer. Commodity applies for Tawarruq transaction is subject to the Commodity Broker.

Product Details

The benefits of this product are as below:

| Financing Limit |

The margin of financing is up to 90% based on the applicant’s eligibility limit. |

| Financing Tenure |

The maximum financing period is 240 months (20 years) or until the age of 60 years on the maturity date of the financing (whichever is earlier). |

| Rate |

Profit Rate

From Standardised Base Rate (SBR) + 2.35% per annum on monthly rest basis

*Subject to Margin of Financing and customer’s credit evaluation

Ceilings Profit Rate (CPR)

SBR + 7.75% p.a. or 10% p.a.; whichever is higher for the calculation of Sale Price

Effective Profit Rate (EPR)

At the current rate and did not exceed the ceiling profit rate charged and is calculated on a monthly balance.

Note: Current SBR is at 2.75%

|

Fee & Charges

| Stamping Fees |

As per the Stamp Act 1949 (Revised 1989). |

| Legal & Disbursement Fees |

Include solicitors fees for financing documentation, registration of charge, land search and bankruptcy search and other related charges. |

| Brokerage Fee |

Based on the value of the financing facility or any broker fee amount set by the commodity trading platform (subject to service tax (if any) or any tax set by the relevant Minister).

|

Note :

- The Bank will notify at least 21 days notice before any changes are made to the fees and charges (if applicable)

- Fees and charges are subject to Sales and Service Tax (“SST”) of 8% (if applicable)

PDS-HARTANI-i-ENGLISH

Download A5 Flyers

CONTACT US

Special Advance for Islamic Account-i (SAFIA-i) is a short term financing facility offered to Agrobank’s Term Deposit-i account holder.

This facility allows customer to obtain cash flow to meet their financial needs without having to uplift their Term Deposit-i account.

Implementation of this product is based on the Tawarruq transactions.

Product Details

| Financing Limit |

Minimum: RM 5,000.00

Maximum: up to 150% from the Term Deposit-i amount

|

| Financing Tenure |

The financing period is subject to margin financing as below :

Margin financing up to 100 %

Minimum: 3 months

Maximum: 12 months

Margin financing up to 150 %

Minimum: 3 months

Maximum: 36 months

|

| Profit Rate (Subject to change) |

Profit rate will be based on the margin of financing as per below:-

Financing Margin Up to 100%

Agriculture Sector and Food Industry

Term Deposit-i profit rate + 1.00% p.a.

Non Agriculture Sector and Food Industry

Term Deposit-i profit rate + 2.00% p.a.

Financing Margin Up to 150%

Agriculture Sector and Food Industry

For the first 100%:

Term Deposit-i profit rate + 1.00% p.a.

For the next 101% – 150%:

Standardised Base Rate (SBR) + 4.45% p.a

Non Agriculture Sector and Food Industry

For the first 100%:

Term Deposit-i Profit Rate + 2.00% p.a.

For the next 101%-150%

SBR + 4.95% p.a

Ceilings Profit Rate (CPR):

SBR + 7.75% p.a. or 10 % p.a., whichever is higher for the calculation of the sale price.

Effective Profit Rate (EPR):

At the current rate and did not exceed the ceiling profit rate charged and is calculated on a monthly balance

Note: Current SBR is at 2.75%

|

Fees & Charges

| Stamping Fees |

As per the Stamp Duty Act 1949 (Revised 1989) |

| Brokerage Fee |

Based on the value of the financing facility or any broker fee amount set by the commodity trading platform (subject to service tax (if any) or any tax set by the relevant Minister).

|

Note

- The Bank will notify at least 21 days notice before any changes made to the fees and charges (if applicable)

- Fees and charges are subject to Sales and Service Tax (“SST”) of 8% (if applicable)

Security / Collateral

- Term Deposit-i will be taken as collateral.

- One eligible guarantor is required if the margin of financing 101% – 150%

PDS-SAFIA-i-ENGLISH

FAQ Berkaitan Penjamin Bagi Produk SAFIA-i

CONTACT US

AgroCash-i is a personal financing facility for customers for the purpose of consumer financing mainly related to agriculture and agro-based activity.

The implementation of the product is based on Tawarruq transactions.

Eligibility Criteria

| Age Requirement |

Government Employees

Aged 18 years old and above and not exceeding 60 years old upon the expiry of facility or opted retirement age; whichever comes first

GLC Staff

Aged 21 years old and above and not exceeding 60 years old upon the expiry of facility or opted retirement age; whichever comes first

|

| Eligibility |

Government Employees

Permanent and have served for at least 6 months (confirmed or under probation)

GLC Staff

Permanent staff and has been confirmed with at least one year of service

|

| Additional Eligibility for Financing Limit up to RM250,000.00 |

Government Servant

- Open to Central Government, State Government and Statutory Bodies only

- Permanent and have served for at least 6 months. Calculation of service period includes contractual and/or “interim” service period (if applicable)

- Gross monthly income (including basic salary and fixed allowances) based on customer’s financing eligibility (Biro Perkhidmatan ANGKASA (BPA) deduction, Debt Service Ratio and Net Disposable Income)

- Debt Service Ratio (DSR) is up to 70% only (including applications with Housing Financing)

- Other conditions are as stated above

|

| Min. Salary Requirement |

Government Employees

Gross monthly income (including fixed allowance) more than RM1,000

GLC Staff

Gross monthly income (including fixed allowance) more than RM2,000

|

| Takaful Coverage |

Customer is encouraged to take Skim Takaful Kredit |

Product Details

| Financing Limit |

Government Employees

Maximum RM250,000**

GLC Staff

Maximum RM200,000

(**Please refer to the Additional Eligibility for Financing Limit up to RM250,000.00)

|

| Financing Tenure |

Maximum ten (10) years |

| Profit Rates (Subject to eligibility and current changes) |

i. Profit rate for employee of Federal Government

| Tenure |

Profit Rate |

| Up to 3 years |

SBR + 3.45% p.a |

| 4 to 10 years |

SBR + 3.95% p.a |

ii. Profit rate for State Government, Statutory Body, Pihak Berkuasa Tempatan (PBT) and Government Link Company (GLC)

| Tenure |

Profit Rate |

| Up to 3 years |

SBR + 3.82% p.a |

| 4 to 10 years |

SBR + 4.27% p.a |

iii. Profit rate for application that has unsatisfactory credit assessment:

| Tenure |

Profit Rate |

| Up to 10 years |

SBR + 4.85% p.a |

Ceiling Profit Rate (CPR)

SBR + 7.75% p.a. or 10% p.a.; whichever is higher for the calculation of Sale Price

Effective Profit Rate (EPR)

At the current profit rate and did not exceed CPR and calculated based on monthly balance

Note:

i. Current Standardized Base Rate (SBR) is at 2.75%

ii. Subject to the existing Terms and Conditions of product

|

Fee & Charges

| Type of Fees |

Details of Fee |

| Stamp Duty |

As per the Stamp Act 1949 (Revised 1989). |

| Brokerage Fee |

Based on the value of the financing facility or any broker fee amount set by the commodity trading platform (subject to service tax (if any) or any tax set by the relevant Minister).

|

Note

- The Bank will notify at least 21 days notice before any changes made to the fees and charges (if applicable)

- Fees and charges are subject to Sales and Service Tax (“SST”) of 8% (if applicable)

PDS-AGROCASH-i-ENGLISH

Terma Syarat AgroCash-i (V03_2025) – Clean

Download Flyers (A5)

WHATSAPP US

Mega Partners adalah satu inisiatif pemasaran yang diwujudkan oleh Agrobank bagi mempromosikan produk deposit berpandukan konsep keahlian, rujukan dan ganjaran melalui program Sahabat Agro.

KELAYAKAN

Terbuka kepada:

- Individu warganegara Malaysia, Residen Tetap dan Bukan Warganegara yang bermastautin di Malaysia

- Bukan Individu seperti, tapi tidak terhad kepada Pertubuhan/Persatuan/Kelab/Koperasi/ Perniagaan Tunggal/Perniagaan Perkongsian/Syarikat Didaftarkan/Sekolah/Masjid/Rumah Anak-anak Yatim

- Berumur 18 tahun ke atas

KELEBIHAN PROGRAM

- Ganjaran tinggi, sehingga 1.4% setahun

- Tiada risiko kewangan

- Pendapatan pasif setiap bulan

- Tiada had deposit

- Produk patuh syariah melalui konsep Hibah Mu’allaqah (Hibah Bersyarat)

- Boleh dijadikan inisiatif amal jariah

Muat turun risalah

Muat turun Terma dan Syarat

Ar-Rahnu financing is a Shariah-compliant facility that uses gold as collateral to guarantee debt obligations. The financing period and rate are determined in advance and agreed upon by both parties (Agrobank and Customer).

Shariah Concept

- Ar-Rahnu financing adopts the concept of Tawarruq involving two (2) separate sale and purchase contracts. The first involves the sale of assets by the seller (the Bank) to the buyer (the Customer) on a deferred basis. Subsequently, the buyer of the first sale transaction will sell the same asset to the third party in cash and on the spot.

- Rahn, on the other hand, refers to a mortgage contract whereby one party as the Pawnbroker (“Rahin”) makes a pledge on the asset as collateral (“Marhun”) to guarantee its liability or debt obligations to the other party, the Pawnbroker (“Murtahin”) in the event of a failure on the part of the Pawnbroker in fulfilling the obligation.

Eligibility

- Individual

- Open to Malaysian citizen or permanent residents

- Aged from eighteen (18) to seventy (70) years old

- Not declared bankrupt

Benefits

- Fully Shariah compliance product

- Free from Riba

- No changes in profit throughout the financing period

- No additional fee charged for early clearing of the financing

- Financing up to 80%

- Financing tenure up to 18 months with the profit rate payment in every 6 months

- Profit rate as low as *RM0.55 per month

- Fast, easy and safe

- Fully protected by Takaful

- Customers have the option to choose Takaful coverage in the event of death or Total Permanent Disability (TPD)

- Free gold cleaning service for selected branches

- Over 100 branches nationwide

Product Features

| Financing Limit |

- Minimum Limit per Financing Account: RM100

- Maximum Financing Aggregate per Customer: RM300,000

|

| Margin of Finance |

|

|

Financing Tenure

|

- Financing Tenure is 18 months.

|

Monthly Profit Rate

|

Marhun Value

(Current Gold Price)

|

Monthly Profit Rate with Every RM100 Marhun Value

|

| RM100 – RM2,000 |

RM0.55

|

|

RM2,001 – RM5,000

|

RM0.65

|

|

RM5,001 and more

|

RM0.80 |

Type of Collateral (Marhun)

Gold Jewellery

- 999, 950, 916, 875, 835, 750

- Accept 916 Gold Jewellery with gemstones with Margin of Finance up to 60%* for selected branches. Click for branch list

Gold Coin and Gold Wafer

- Minimum weight from 1 gram to 50 gram (all branches)

- Minimum weight from 1 gram to 100 gram (selected branches) Click for branch list

- Gold grade: 916 – 999

Note:

- Accept all types of gold wafer and gold coin including gold certificate from the employer.

- All types of gold coin and gold wafer issued/distributed by Distributor Companies, State Governments and Banks in Malaysia EXCEPT companies that do not have approval/permission (as well as blacklisted by Bank Negara Malaysia (BNM)). Financial Consumer Alert List – Bank Negara Malaysia (bnm.gov.my)

How to Apply

- Complete the application form and bring your Identity Card along with gold jewellery/gold wafer/gold coin for collateral at the nearest Ar-Rahnu Agrobank counter.

Payment Method

- Profit rate payments can be made through branches, ATM, CDM, and Internet Banking.

Redemption Method

- Redemption of collateral can only be made at branches where the pledge is made with the payment of redemption in a lump sum before or during the maturity of the financing.

- Make Ar-Rahnu Financing (Tawarruq) a facility to get instant cash, solve cash flow problems and avoid illegal lending activities.

‘CONVERT YOUR GOLD TO CASH’

Ar-Rahnu Product Disclosure Sheet

Ar-Rahnu Terms and Conditions

List of Ar-Rahnu Branches

Download Ar-Rahnu Generic Flyers

Download Ar-Rahnu Mandarin Flyers

Download Ar-Rahnu Tamil Flyers

CONTACT US

WHATSAPP US